Mounted coverage and annuity merchandise assures are issue towards the statements having to pay capacity of the issuing company; not assured by any lender or perhaps the FDIC.

You invested your Doing the job years accumulating this wealth. Now it’s time to take advantage of of it with powerful tax and wealth management.

FinanceBuzz will make revenue whenever you simply click the links on our internet site to some of the goods and offers that we point out. These partnerships usually do not impact our opinions or tips.

Income annuities which are issued by highly rated insurance policy companies that possibly shell out out guaranteed life time income or may be exchanged to contracts that do

Probably better returns. Some alternative investments, such as personal equity and hedge resources, have the opportunity to deliver increased returns than traditional investments in excess of the long run.

Those people are some of the vital advantages of retirement plans for that self-utilized or small business owners.

Lots of people rely on 401k strategies for retirement savings, but these strategies have restrictions. Exploring 401k retirement approach alternatives is beneficial:

Which has a Roth IRA, you add after-tax revenue now, so as soon as You begin withdrawing, your retirement revenue—both of those earnings and also your investment—is tax-absolutely free. Roth IRAs would not have a provision for essential minimum amount distributions.

But any time you strike age 65, any income within the account could be withdrawn and utilized for any goal with no penalty, nevertheless you’ll owe taxes around the withdrawal at everyday cash flow prices. This feature would make the HSA functionality like a conventional IRA, if held to age sixty five.

To improve your retirement accounts, experts advise purchasing both of those a 401(k) and an IRA in the following order:

Max out your IRA: Flip to the IRA — either a best site Roth or regular, depending on your preferences — for those who’ve maxed out your 401(k) match or Should your employer doesn’t give you a 401(k) program or maybe a match.

An additional draw back: You may not manage to invest in what you would like, given that your choices are limited to the program’s investment possibilities.

A Roth IRA is an excellent option for its huge tax strengths, and it’s a superb preference should you’re in the position to expand your earnings for retirement and keep the taxman from touching it once again.

These goods are for wealthier Individuals who have currently maxed out all other retirement savings motor vehicles. Should you've achieved the contribution restrictions in your hop over to here 401(k) as well as your IRA, then you might look at investing in this kind of lifetime insurance policies.

Kelly McGillis Then & Now!

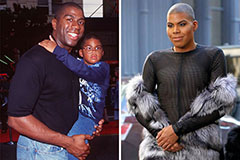

Kelly McGillis Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!